Today’s financial trading ‘floor’ is a data warehouse with racks of servers conducting trades. There has been a growing focus in recent years on the need to distribute accurate time across this trading ‘floor’. The European Union (EU) financial regulator ESMA’s MiFiD2 directive took effect in January 2018 and this spells out the requirement for accurate time across the trading floor. The SEC in the USA also has Rule 613 for the Consolidated Audit Trail, which requires traders to “synchronize the business clocks they use to record the date and time of any reportable event”. Financial regulators are investigating and in some cases mandating the distribution of accurate time across a trading computer infrastructure.

The primary driver for accurate time to be delivered across this infrastructure is to address the fundamental question that Regulators have when conducting an investigation - "What exactly happened, and who caused it?". By delivering accurate timing across the trading computing infrastructure, we can ensure that all clocks in the infrastructure are synchronized. This in turn means the time of any event recorded by different elements can be correlated. And that in turn means the sequence of events can be determined. Did A happen first or did B? Did A cause B or the other way round? And ultimately - "What exactly happened, and who caused it?". Accurate time allows the correct sequence of events to be determined when conducting forensics.

The next question is then “how accurate does the time have to be?”. This is where the volume of transactions come into play. Say we have one transaction per second. Sampling the data twice as fast (every 0.5 seconds) will give us sufficient information to determine the sequence of events (applying the principles from Nyquist sampling theory, which tells us that we need to sample at twice the frequency of the maximum event frequency). In other words, timing accuracy of 0.5 seconds would be sufficient. Now say there are 100 transactions per second – the timing accuracy needs to be 100 times better, so 5 milliseconds. Trading algorithms and infrastructure hardware speeds continue to evolve to increase the volumes of trades. In today’s trading environment, it is not uncommon to target accuracies of 1 microsecond at the server hardware level and 1 millisecond at the trading application level. The increased volume of trades demands and drives greater timing accuracy.

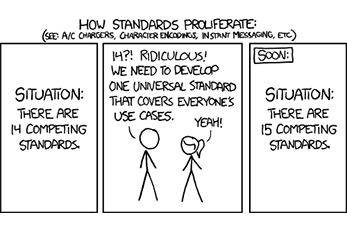

The solution? Referencing a time source like GPS or a UTC time service and distributing timing across the datacenter using 1588 Precision Timing Protocol (PTP) is the primary methodology being deployed by the Financial community to achieve the above requirements.

Anand Ram

VP Business Development

Related test product: Calnex SNE